We found many asset managers were locked into rigid and aging middle office reconciliation systems. Because the majority of these systems are simple and don't learn, asset managers can't reduce labor costs.

Our work with several major, global asset managers presented several major challenges:

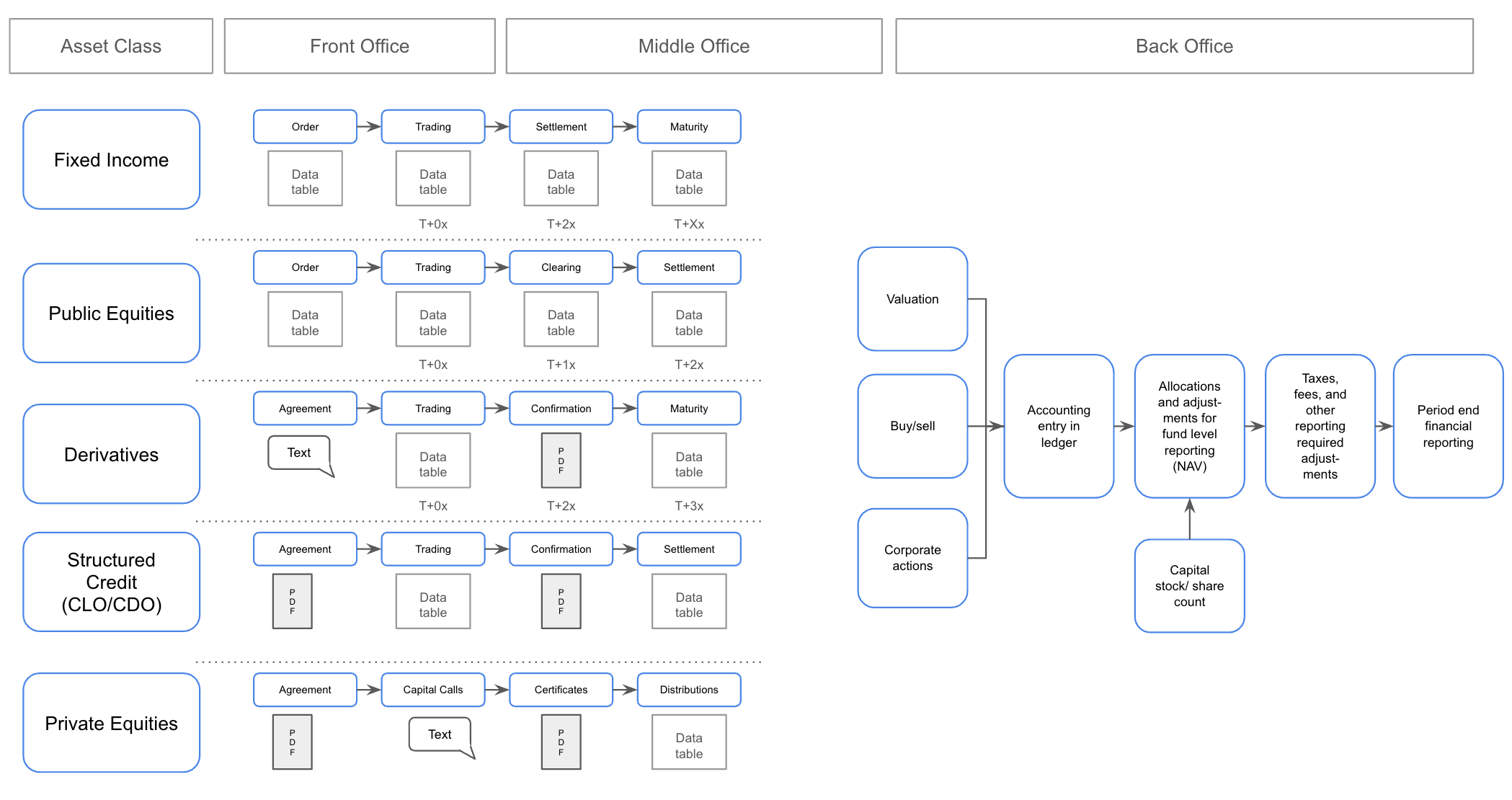

Our middle office AO solution provides a platform to rapidly ingest any data from various electronic databases as well as from contracts and PDFs. As illustrated below, each asset class may flow through several machine learning "states." Our algorithm can track the position through each state - like a trip map - and help provide asset managers a more accurate views on their IBOR to ABOR.

We help setup a programmable pipeline of all data and document sources first. Then we assist in the development of more sophisticated reconciliations. These often start as incidetn detection checks, but can be integrated to feed more sophisticated predictive algorithms. Finally, we help rigorously test the algorithms. Once the algorithms and checks are operational, we compare them to current reconciliations to gauge the redundancies and help identify recs and labor costs that can be reduced.

Because our method accelerates the managing of different data sources and configuration of reconciliations, we are able to create very sophisticated algorithms such as incident detection checks which are setup to look for the same conditions that caused errors and delays in the past.

There are three major outcomes we have achieved in this financial reporting case.